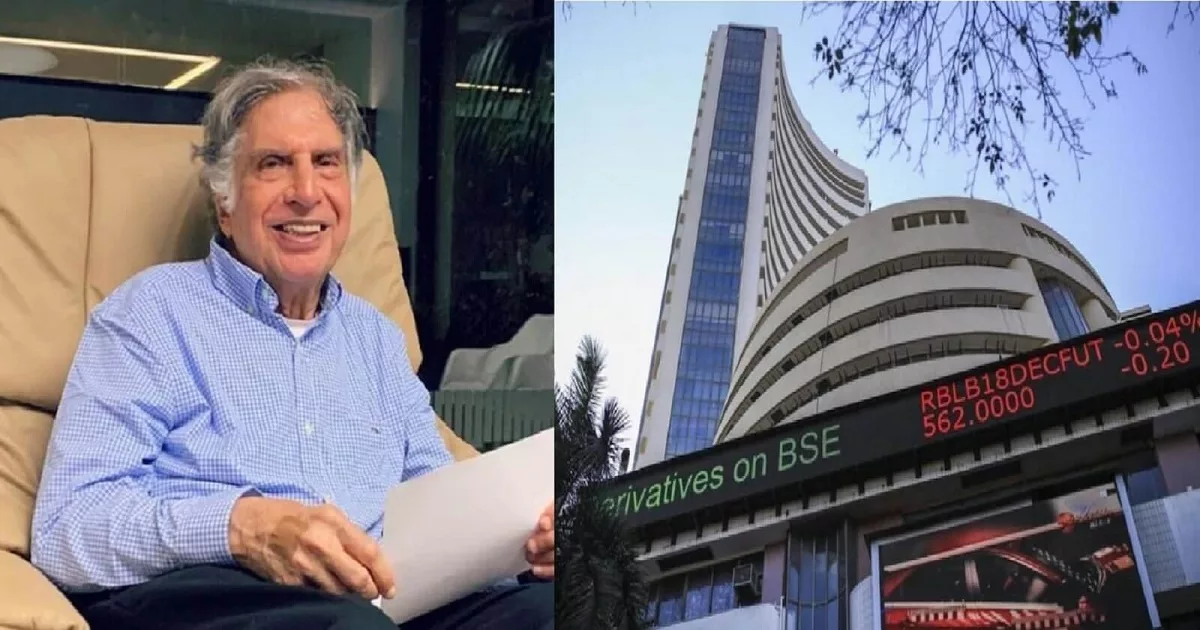

Tata Steel Share Price 📈💰

1. Tata Steel’s share price has witnessed a significant surge in the stock market, reaching a historic high of Rs 136.70 on Friday, marking a 3.50% increase.

2. The current share price is the highest in the past 52 weeks, indicating a positive trend for the company. In comparison, the share price had plummeted to Rs 101.60 in December last year.

3. Stock experts and market analysts are predicting further growth in the short term for Tata Steel shares. JM Financial, a brokerage firm, has recommended buying the shares with a target price of Rs 150, implying potential growth in the future.

4. With a market capitalization of Rs 1,67,734.47 crore, Tata Steel continues to be a strong player in the market. The company’s financial stability and performance make it an appealing investment option.

5. Tata Steel has recently signed an MOU with Imperial College London to establish an innovation center in sustainable design and manufacturing. This center aims to accelerate technological advancements, attract talent, and strengthen the industry-academia collaboration in strategic areas.

6. To achieve this goal, Tata Steel plans to invest $10 million in facility upgrades over the next four years, showcasing its commitment to innovation and growth.

7. The company’s quarterly results for September indicate a decrease in total revenue of 7.84%, amounting to Rs 55,910.16 crore. However, when compared to the same quarter last year, the decline is only 7.14%.

8. Despite the decrease in revenue, Tata Steel managed to narrow its net loss to Rs 6,511.16 crore in the July-September quarter, compared to a net profit of Rs 1,297.06 crore in the same period last year.

By keeping a close eye on Tata Steel’s share price and market performance, investors can make informed decisions and potentially benefit from its growth prospects. 💼📊💸

Disclaimer: This is News Coverage with Opinions of Experts and Should Not Be Taken as Direct Market Buying Tip. Market is always subject to risk. We recommend taking our content as research before investing.