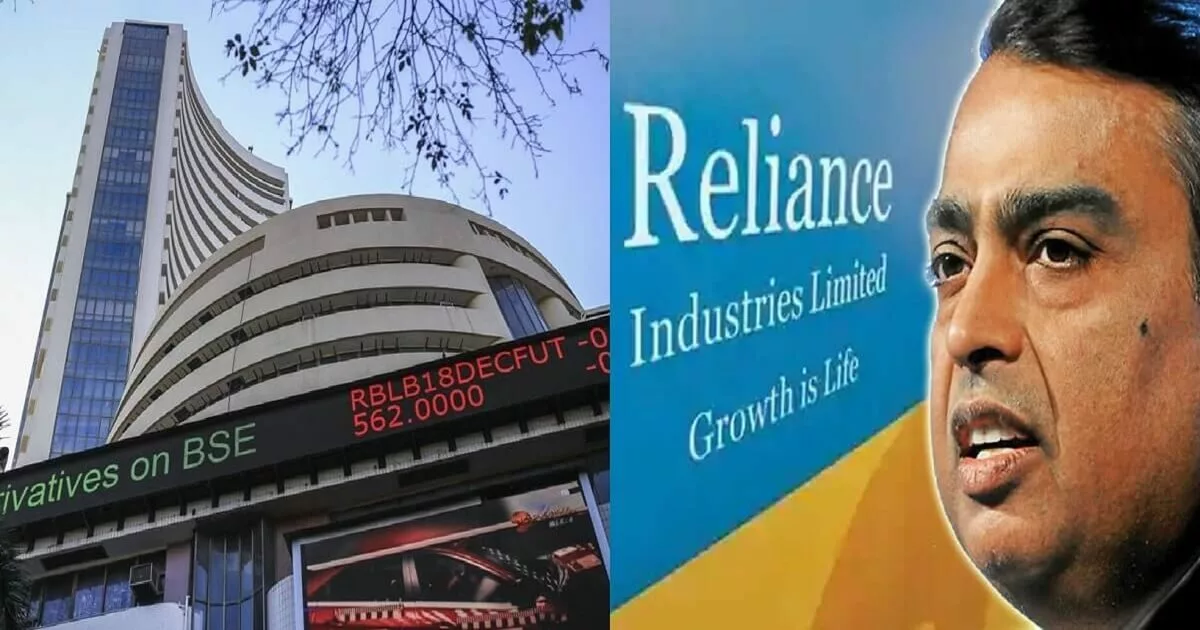

Reliance Share Price Surges Amidst Reports of Potential Merger with Walt Disney

📈🤝 Industry mogul Mukesh Ambani is set to expand his empire into new territories as reports suggest a media business merger agreement between Walt Disney and Reliance Industries. Bloomberg reports indicate that both companies have reached a consensus on a merger deal, although no official announcement has been made.

🤝📊 According to the report, post-merger, Mukesh Ambani will hold a 61% stake in the unit that will be formed. Meanwhile, Disney is evaluating its position in the growing Indian market for competition. Neither Reliance nor Disney has issued a statement on the matter.

📰💰 Reliance’s acquisition of Tata Play will be the basis for the distribution of shares involving Disney’s assets in the country. The report also suggests that Reliance Industries is considering acquiring Tata Play Limited. Disney holds a stake in the Tata group company, with a current 50.20% ownership in Tata Sky.

👥💼 As of now, Tata Sons holds a 50.20% stake in Tata Play, with Disney and Singapore investment firm Temasek holding the remaining shares. If the merger is successful, Reliance and Disney will create a strong media company in India.

💸🔝 Reliance Industries is set to invest $1.5 billion for a 61% stake in the merger unit. Through Jio, Reliance has already begun competing directly in the media industry market. With the acquisition of digital rights for IPL, Reliance’s position has significantly improved.

Disclaimer: This is News Coverage with Opinions of Experts and Should Not Be Taken as Direct Market Buying Tip. Market is always subject to risk. We recommend taking our content as research before investing.