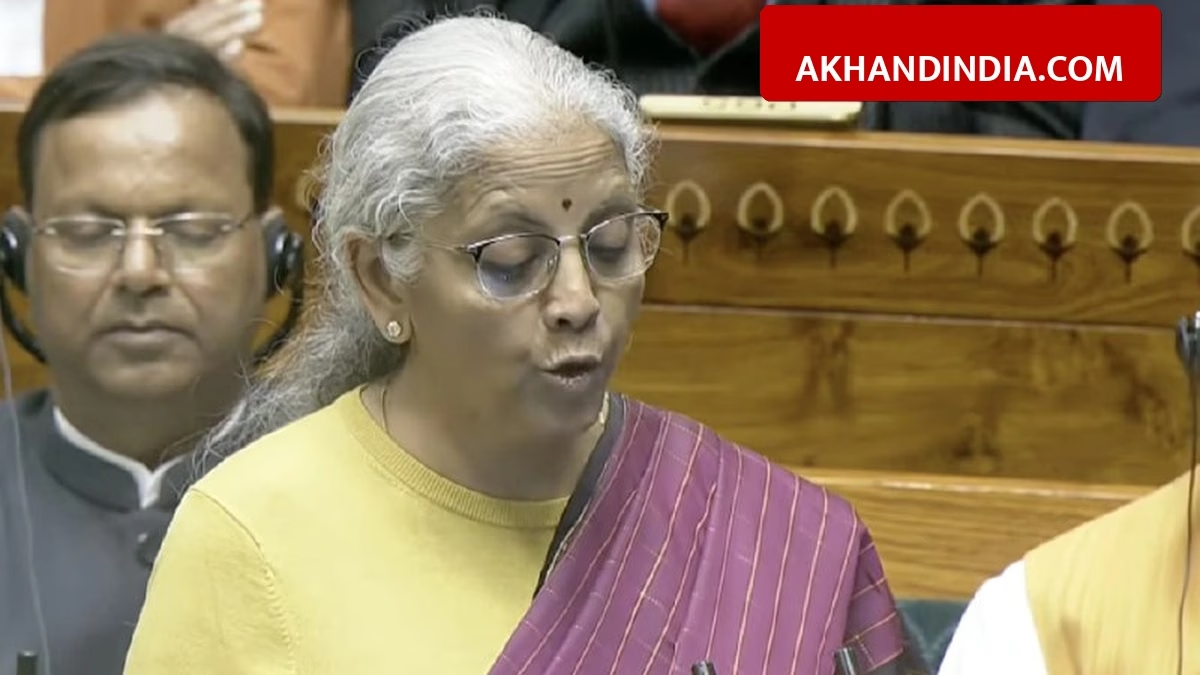

Finance Minister Nirmala Sitharaman presented the Union Budget 2026 on February 1 and announced major changes in income tax rules. The government has decided to bring a new Income Tax Act from April 1, 2026. Along with this, the deadline for filing revised income tax returns has been extended, giving relief to taxpayers who miss the initial dates.

New Income Tax Act 2025 Details

The new ‘Income Tax Act, 2025’ will come into effect from April 1, 2026. This new law will replace the old Income Tax Act of 1961, which has been in place for 64 years. The government wants to make tax laws easier for common people to understand by simplifying the language used in the official documents.

The main goal of this new act is to reduce the number of sections by almost 50 percent. A major change is the removal of confusing terms like ‘Assessment Year’ and ‘Previous Year’. Instead, a single term ‘Tax Year’ will be used in the new system to avoid confusion among taxpayers regarding the time period of their earnings.

Changes in ITR Deadlines and Tax Rebate

The government has extended the time limit for filing Revised and Belated income tax returns. Earlier, the last date was December 31, but now it has been extended to March 31 of the relevant tax year. This facility will be available by paying a nominal fee. This gives taxpayers three extra months to correct mistakes or update missing information in their returns.

There are also important updates regarding tax limits and penalties announced in the budget:

- Tax Free Limit: Under the New Tax Regime, income up to ₹12 Lakh will be tax-free as the Section 87A rebate is increased to ₹60,000.

- Filing Dates: For salaried people (ITR-1 and ITR-2), the deadline remains July 31. For non-audit businesses, it is proposed to be August 31.

- TCS Reduction: Tax Collected at Source (TCS) on foreign tour packages has been reduced from the higher slab to just 2%.

- Penalty Rule: If someone hides income or gives wrong information, a penalty equal to 100% of the tax amount will be charged.