What’s inside:

This article discusses the Bihar Student Credit Card Scheme launched by the Nitish government to support students’ education.

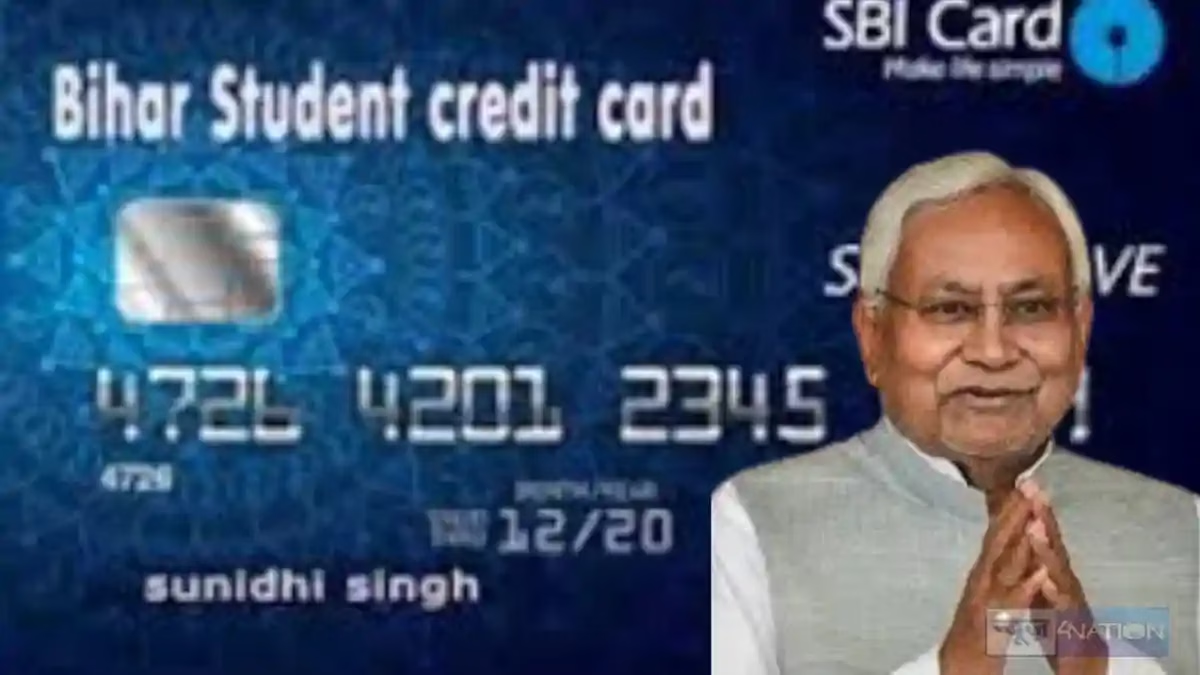

The Bihar government, led by Nitish Kumar, has launched the “Bihar Student Credit Card Scheme” on Gandhi Jayanti. This initiative aims to help students from low-income families who often struggle to find funds for further studies after completing their 12th grade. The scheme is designed to ease the financial burden and offer support to those aspiring for higher education.

This scheme allows eligible students to access an interest-free loan of up to ₹4 lakh. To qualify, students must be citizens of Bihar, have passed their 12th grade from a recognized institution, and have an annual family income of less than ₹6 lakh. Additionally, applicants must be under 25 years of age and plan to enroll in a recognized course.

With this financial aid, students can cover various educational expenses such as tuition fees, purchasing laptops or computers, buying books and stationery, and even paying for accommodation if studying away from home. This support aims to ensure that financial issues do not hinder students from achieving their academic goals.

The scheme is not just about loans; it represents a significant step towards enhancing educational opportunities for many in Bihar. It aims to provide hope to those who have previously had to abandon their studies due to financial constraints. Students can repay the loan in installments after securing a job, making it more manageable.

In a state where education and employment are hot topics, this initiative is seen as a critical move by the Nitish government. While there may be political criticisms, the scheme has the potential to positively impact countless families and encourage students to pursue their dreams without worrying about money.

Summary:

- The Bihar government has launched a credit card scheme for students.

- Eligible students can get up to ₹4 lakh as an interest-free loan.

- Applicants must be from low-income families and under 25 years of age.

- The loan can cover tuition, laptops, books, and accommodation costs.

- The initiative aims to support students in pursuing higher education.