Bank Cheque Rules | Introduction to Financial Transactions in the Digital Era

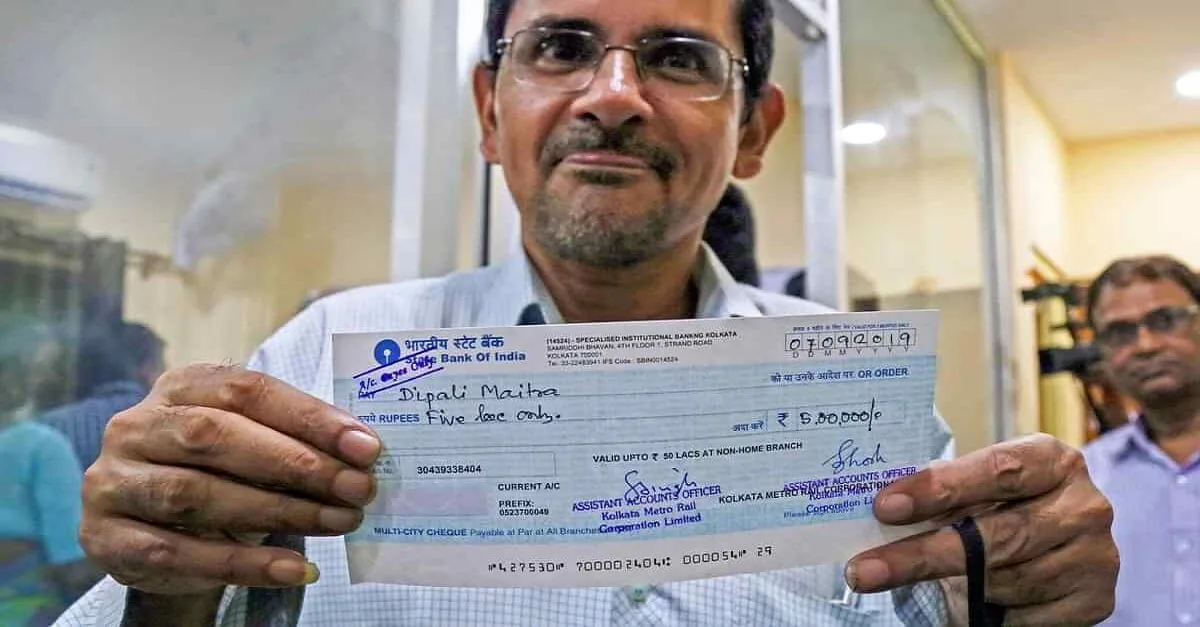

Nowadays, financial transactions have become incredibly easy with the introduction of digital media. With just a few clicks, transactions can be completed instantly through various channels such as net banking, ATM, and checks. However, it is crucial to be cautious and avoid any mistakes that could potentially lead to financial trouble.

One small mistake in your financial transactions, such as a bounced check, can have severe consequences, including potential imprisonment or misuse of your check. Therefore, it is essential to familiarize yourself with the necessary rules and regulations related to checks.

Why is the back of a check signed?

Many people still wonder why the back of a check needs to be signed. It is important to note that not all types of checks require a signature on the back. Only bearer checks, which do not contain any specific person’s name, need to be signed on the back. Order checks, on the other hand, do not require any signature on the back.

Understanding Bearer Checks and Order Checks

Bearer checks, also known as vector checks, require you to visit the bank and deposit them. These checks do not have any specific person’s name on them, hence the need for a signature on the back. However, bear in mind that carrying a bearer check can be risky as it can be stolen and misused.

The bank accepts bearer checks only after verifying the signature on the back to ensure the transfer of funds and avoid any potential mistakes for which the bank might be held responsible. Additionally, for bearer checks exceeding fifty thousand rupees, an address proof may be required.

No Signature Required for Checks and Order Checks

If a bank customer wishes to withdraw money using a bearer check from their account, there is no need to sign the back of the check. Similarly, checks and order checks payable to an individual do not require any signature on the back. The bank thoroughly investigates order checks to ensure proper payment to the intended recipient.

It is important to keep these rules in mind to avoid any complications or misunderstandings when dealing with checks. Proper understanding and adherence to these rules can help prevent financial losses and ensure smooth transactions.

Disclaimer: Investing in mutual funds and the stock market carries inherent risks. It is advisable to consult with a financial advisor before making any investment decisions. AkhandIndia.com shall not be held liable for any financial losses incurred.

News Title: Bank Cheque Rules – Understanding the Importance of Signature on the Back of Checks (Published on September 16, 2023)